Anúncios

Discover how the Plazo Card combines savings, convenience, and innovation

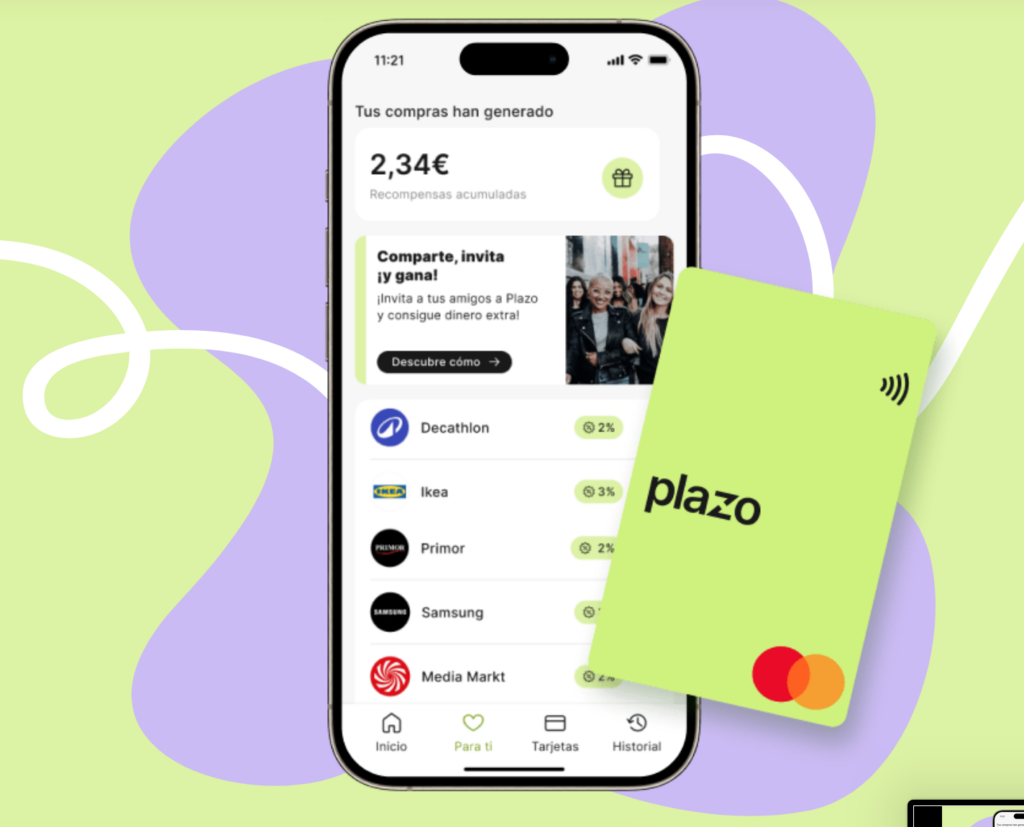

In the era of digital finance, what do we seek most in a debit card? Zero fees, real benefits like cashback, and simplified financial management. The Plazo Card checks all these boxes as an innovative and accessible solution.

With an associated free bank account, a cashback program offering up to 3% on supermarket purchases, and worldwide acceptance as a Mastercard, Plazo is more than just a card—it’s a financial ally.

Whether you’re a frequent supermarket shopper, a traveler, or someone looking to manage your expenses better, this card brings unique benefits to your daily life.

Get ready to discover all the details, benefits, and how to apply for yours!

What is the Plazo Card?

The Plazo Card is a Mastercard debit card designed for consumers who value savings and convenience.

Anúncios

Unlike other debit cards, it offers an attractive cashback program, providing up to 3% back on supermarket purchases and 1% on other expenses.

But that’s not all. The Plazo Card has an associated fee-free bank account, eliminating common charges such as issuance, maintenance, and renewal fees. Additionally, all operations can be managed seamlessly through the Plazo app.

This card is particularly appealing to those seeking a simple and cost-effective solution for both domestic and international purchases. It ensures total financial control at your fingertips.

Anúncios

Why Choose a Debit Card with Benefits?

Millions of people prefer debit cards to avoid the debt and interest charges associated with credit cards.

But why opt for a debit card that offers additional benefits? Here are some compelling reasons:

- Immediate Control: With a debit card, you only spend what you have available, helping you avoid debt accumulation.

- Additional Benefits: The Plazo Card enhances the debit card experience by offering cashback, allowing you to save directly on purchases.

- No Fees: While many cards charge monthly or annual fees, the Plazo Card has no hidden costs, making it a financially smart choice.

A card like Plazo is a strategic option for those who want to save while managing their daily expenses.

Key Features of the Plazo Card

What makes the Plazo Card a unique solution in the market? Let’s explore its main highlights:

- Attractive Cashback:

- 3% on Supermarkets: Perfect for regular shoppers looking to maximize savings.

- 1% on Other Purchases: Additional cashback applies to any expense category.

- Zero Fees:

- There are no charges for issuance, maintenance, or renewal.

- Free ATM withdrawals are a rare benefit among many cards.

- Global Acceptance:

- As a Mastercard, it is accepted at millions of establishments worldwide, providing flexibility for international travel.

- Advanced Technology:

- The Plazo app allows users to manage all transactions in real-time, offering full control and enhanced security.

- Associated Bank Account:

- An integrated solution that eliminates the need for multiple accounts and financial products.

These features make the Plazo Card a practical and accessible choice for various consumer profiles.

How Does Cashback Work in Practice?

The cashback program offered by the Plazo Card is one of its most appealing features, but how does it work exactly? Let’s break it down with a practical example:

Imagine you spend €400 on supermarket purchases throughout the month. With 3% cashback, you’ll receive €12 back directly into your account. Suppose you also spend €300 on other expenses, such as clothing or dining out. With 1% cashback, you save an additional €3.

By the end of the month, your total cashback would amount to €15.

While this may seem modest, over a year, it translates into significant savings—especially for those with consistent spending habits.

Best of all, cashback is accumulated automatically, without manual requests, making the process effortless and efficient.

Technology and Convenience: The Plazo App

The Plazo app is the core of the card’s functionality. Designed to provide an intuitive and efficient user experience, it centralizes all operations in one convenient place.

With the app, you can:

- Track Transactions in Real-Time: View each purchase or withdrawal in your transaction history.

- Manage Limits: Adjust spending limits to maintain greater financial control.

- Lock or Unlock Your Card: A practical solution in case of loss or theft.

- Request a Physical Card: If you prefer to use it outside the virtual format,

The app’s technology ensures convenience while prioritizing security, safeguarding your information, and providing round-the-clock support.

Who Should Use the Plazo Card?

The Plazo Card is ideal for a wide range of profiles, including:

- Savvy Shoppers: Individuals looking to save on regular purchases.

- Travelers: Those who need a card with global acceptance and no excessive fees.

- Young Adults and Students: Users who prefer digital solutions that are hassle-free and straightforward.

- Families: Perfect for maximizing cashback benefits on supermarket purchases.

If you value convenience, savings, and modern technology, the Plazo Card could be an excellent choice.

Points to Consider Before Choosing the Plazo Card

While the Plazo Card offers numerous attractive advantages, it’s essential to evaluate some factors that may influence your decision:

- Category-Specific Cashback Limitations

- The highest cashback percentage (3%) applies only to supermarket purchases. If you spend more in other categories, such as entertainment, dining, or clothing, your savings will be limited to 1%.

- This restriction may be a drawback for users who prefer broader cashback coverage across multiple spending categories. However, this benefit is advantageous for those who frequently shop at supermarkets.

- App-Only Management

- All operations related to the Plazo Card, from application to transaction control, are conducted exclusively through the app. This could be a challenge for users unfamiliar with technology or who prefer traditional methods.

- On the other hand, app-based management offers advantages such as convenience and real-time monitoring, but being comfortable with smartphones and financial apps is essential.

- Target Audience Limited to Spain

- The Plazo Card is designed for Spanish residents, which may restrict its availability to users in other countries. While it is internationally accepted, support and conditions may be more limited for those not residing in Spain.

- If you’re an expatriate or frequent Spain regularly, this characteristic may pose less of an issue. However, those seeking a card with a broader global reach might need to consider alternatives that are more aligned with their needs.

- International Transaction Fees

- Despite the absence of issuance and maintenance fees, checking the costs associated with currency conversion and international transactions is important. This is particularly relevant for users who frequently purchase currencies other than the euro.

- Automatic Cashback with Rules

- Although cashback is processed automatically, certain rules may apply, such as limits or timeframes for crediting cashback amounts. Be sure to review the terms carefully to avoid surprises.

These considerations highlight the importance of aligning the Plazo Card with your expectations and spending profile before applying.

How to Apply for the Plazo Card: Complete Guide

Applying for the Plazo Card is a fully digital process designed for speed and convenience. Here’s a step-by-step guide to ensure you get your card without any hassle:

Download the Plazo App

The first step is to visit the official website and choose the app store for your device to download the Plazo app. It’s free and can be quickly installed on Android or iOS devices.

Debit Card

Complete Initial Registration

Once you open the app, you must provide personal information such as your full name, date of birth, and address. A valid mobile phone number is also required, as it will be used to verify your identity and facilitate communication.

Prepare Your Documents

Plazo requires official identification to complete the application process. Accepted documents include:

- INE (National Identity Document) or IFE (Voter’s Card) is valid in Spain.

Additionally, you’ll need to take a selfie to confirm your identity. This step, known as biometric verification, enhances security and helps prevent fraud.

Data Verification

After you submit your information and documents, the system automatically reviews them to validate your details. This process is fast; in most cases, the virtual card is made available within minutes of approval.

Instant Access to Your Virtual Card

Upon approval, the virtual Plazo Card will be accessible directly through the app. You can use it immediately for online purchases and NFC payments (if your device is compatible).

Request the Physical Card (Optional)

If you prefer, you can request the physical version of the card. To do this:

- Go to the app settings menu and select the option to request a physical card.

- Confirm your delivery address and wait for the shipment, which is typically fast and secure.

With the Plazo app downloaded and your card activated, you’re ready to experience the convenience and benefits of this innovative debit card. Whether you choose the virtual card, the physical card, or both, Plazo ensures an efficient and seamless financial solution tailored to your needs.

Looking for a credit card option instead? Check out the article below to learn about AXI, another fantastic card choice!