Credit Cards

Mission Lane Visa® Credit Card Review: build credit fast

Like any other credit card, the Mission Lane Visa® Credit Card will always have your back, just apply for it, or learn more about it down below.

Advertisement

Build your credit without a security deposit!

If you have less-than-perfect credit, you know how tough it can be to find a credit card that doesn’t require a security deposit. The good news is that the Mission Lane Visa® Credit Card bucks that trend, making it easier to build your credit.

Another plus is its reasonable annual fee. However, it’s important to consider all the card’s features to see if it’s a good fit for you. Read on to learn all the details!

| Credit Score: | 629 or lower FICO score; |

| Annual Fee: | From $0 up to $59; |

| APR: | 19.99% up to 29.99%; |

| Welcome Bonus: | None; |

| Rewards: | None. |

How is the Mission Lane Visa® Credit Card performing?

Overall, the Mission Lane Visa® credit card performs well and appears to be a popular choice, with over 2 million users already on board.

The product doesn’t require a credit score and has a reasonable annual fee, making it stand out considerably compared to other competing options on the market.

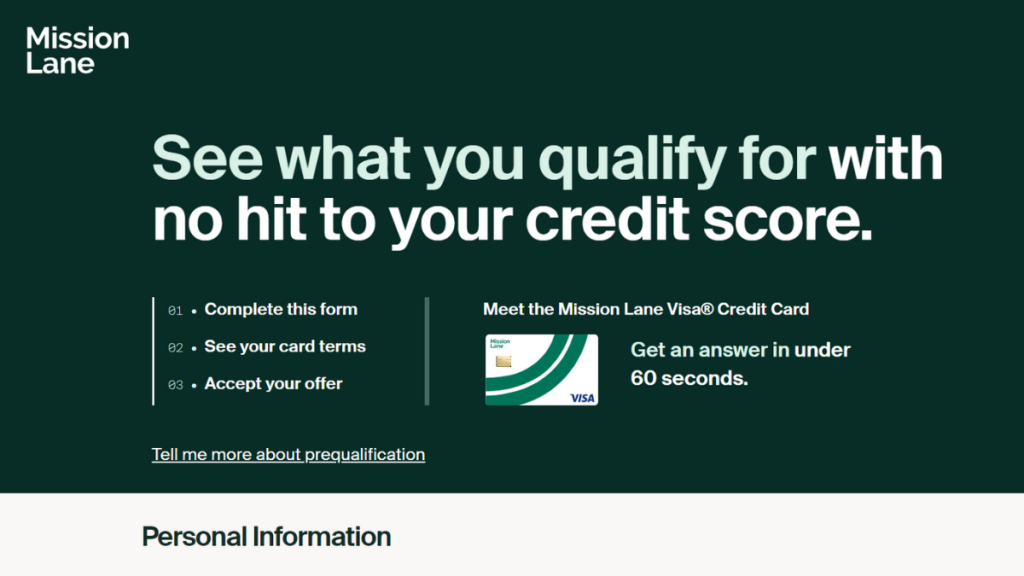

We understand that applying for a credit card with the uncertainty of approval can be a little scary, given the fear of affecting your credit history.

But we have good news! With the Mission Lane Visa® Credit Card, you don’t have to worry. It allows you to pre-qualify without impacting your credit score, so you can see if you’re likely to be approved before you apply.

A look at the benefits and challenges of Mission Lane Visa® Credit Card

The Mission Lane Visa® Credit Card has much to offer. Are you ready to dive deeper into it? Let’s take a closer look at its pros and cons.

A closer look at the benefits of Mission Lane Visa® Credit Card

- No credit history needed: Unlike many other cards, you don’t need a strong credit score to be approved for the Mission Lane Visa® Credit Card. This makes it a great option for those who are just starting to build their credit or have had some credit challenges.

- Quick and easy application: The Mission Lane Visa® Credit Card application process is quick and easy. You can apply online!

- No security deposit: Unlike many other credit cards, the Mission Lane Visa® Credit Card does not require a security deposit, which can save you hundreds of dollars upfront.

- Pre-qualification without impacting your credit score: You can pre-qualify for the Mission Lane Visa® Credit Card without impacting your credit score. This allows you to see if you will be approved before applying.

As you can see, the Mission Lane Visa® Credit Card is designed for people with less-than-perfect credit. It offers several features that make it a great option for those looking to build or improve their credit.

A closer look at the challenges of Mission Lane Visa® Credit Card

- No rewards: Unlike many other credit cards, the Mission Lane Visa® Credit Card offers no rewards. This may not be the best option for those who are looking to earn points, miles, or cash back on their purchases.

- Variable APR: The APR for the Mission Lane Visa® Credit Card is variable and can be high. This is something to remember, especially if you cannot pay your balance in full each month.

- Low initial credit limit: The Mission Lane Visa® Credit Card’s initial credit limit may be low. However, this can be increased over time by using the card responsibly and paying on time.

How to get a Mission Lane Visa® Credit Card: a step-by-step guide

To apply for this card, you might think you need many things to help you, like ten different documents, but believe us, it’s not like that.

Since this card is for people with a simpler lifestyle or those with lower credit scores, the application process is not complex. Just being over 18 is enough to apply for it.

Now, down below, we will talk a bit more about applying for it. If it is something you are interested in, keep reading.

A guide to submitting your application online

To apply for the Mission Lane Visa® Credit Card, you have one and only one way: get an offer. Go to their website and click on “See if I’ll be approved”.

When you click on it, fill out everything and await a response. If you are approved for the card, you will receive an offer via email, and then you can start applying.

Want something different? Try Destiny Mastercard® Credit Card

We conclude this article by emphasizing the importance of studying financial solutions to make an informed decision.

In this regard, a wise choice is to compare credit cards with other options in the market.

Therefore, if you’re still unsure if the Mission Lane Visa® Credit Card is right for you or wish to compare it with other alternatives, we’re here to assist you!

In the article below, you’ll find a comprehensive analysis of the Destiny Mastercard®, a credit card also designed to help users improve their credit scores. Check it out!

Destiny Mastercard® Review

Read this Destiny Mastercard® review and discover how this credit card will help you build credit! Quick and simple application!

You may also like

Chase Freedom Flex® Credit Card Review: Secure a no-annual-fee credit card

Transform your expenses into achievements with the Chase Freedom Flex®. Explore a credit card that goes beyond the ordinary.

Keep Reading

Upgrade Triple Cash Rewards Visa Review: Limit of up to $25,000

Discover how this card offers generous cashback, no annual fees, and flexible payment options. Unlock financial freedom today!

Keep Reading